Corporate Donations / Charitable Donation Scheme

Ballybunion Sea and Cliff Rescue can have many benefits with your donation to us from your business

Corporate Donation

There are many benefits to making a donation to us from your business, including:

- Tax Relief

- Getting featured on our website

- The positivity of helping a local charity

If you would like to know more about donating to us, please get in touch.

Charitable Donation Scheme

The Ballybunion Sea and Cliff Rescue is now part of the charitable donation scheme. Companies or individuals interested supporting the work of BSCR may benefit from this scheme.

Calculating the relief on donations from individuals

All of the below scenarios fall into the same category from any donation ranging from €250 to €1,000,000.

The relief is calculated by grossing up the donation at the specified rate. The specified rate is currently 31%. This is explained in the following example.

- Joan donates €1,000 to an approved body in 2020. The approved body can claim a refund of the tax Joan has paid.

- The tax rate is 31%, so this means that the donation of €1,000 is 69% of the total donation.

- To calculate the relief, the total donation is grossed up as follows: (€1000/69) x 100 = €1449.27.

- The refund amount that can be claimed by the approved body is €449.27.

- Once Joan has completed either the Enduring Certificate or Annual Certificate, the approved body can claim the refund.

The amount of the refund cannot be more than the amount of tax paid by the donor for the same year. So, in example 1, if Joan only paid tax of €350 in 2020, then the maximum refund the approved body can claim is €350.

Tax relief is restricted to 10% of your total income for the year if there is a connection between you, as the donor and the approved body you are donating to.

So how I have seen other people explain it is roughly 45%(44.93%) of the donation someone makes will be available to the charity to claim back in tax assuming the individual is paying tax. The rate they pay tax at is irrelevant once they have paid more than the amount available for the charity to claim back.

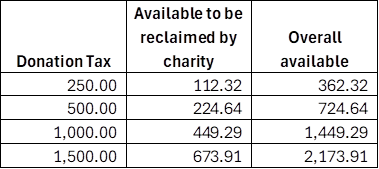

So the following table would apply:

I have highlighted above the restrictions that do apply but other than that the above is the situation for all individuals. A company paying to a charity can claim tax relief on the donation at 12.5% but the charity can not claim anything extra for the company.

Further information on the Charitable Donation Scheme can be found on the Revenue site here:

A list of all Approved bodies in the Charitable Donation Scheme can be found here: